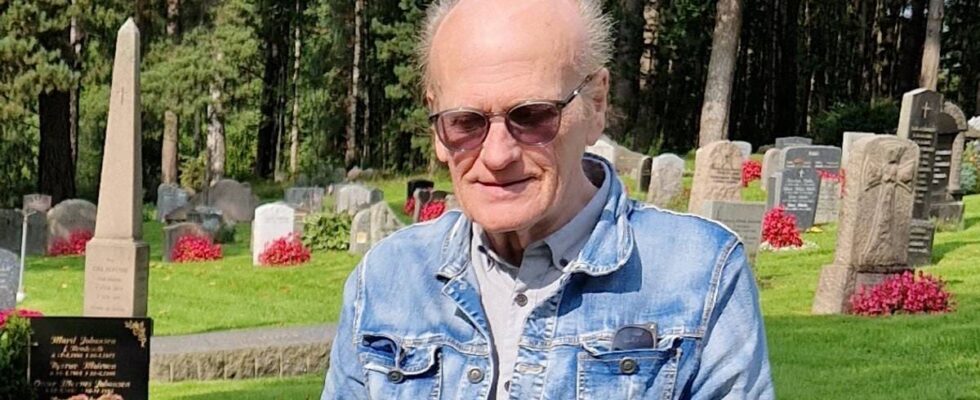

The case in summary: Arild Westhagen received NOK 8,500 a month from the time he was 67 until he was 75, due to Nav’s automatic system which fixed his pension withdrawal at 50 per cent. The family discovered this after Arild’s death, and believes that the system is wrong and that Nav should provide better information about rights and opportunities. Nav explains that the system is such that everyone who works, fully or partially, decides for themselves when to draw a pension and with how much share. Disability benefit is automatically converted into a pension when you turn 67. For those who are partially disabled and partially able to work, the degree of disability will be converted into a pension, while you yourself must choose when the withdrawal of the rest of the pension will start. Nav informs the individual about this, but encourages anyone who is unsure whether they understand the information to get in touch for help. Arild’s son, Eivind Westhagen, believes that Nav could improve the information by using better language and by including information about the withdrawal rate in each monthly payment. The family has calculated that Arild would have received approximately NOK 816,000 more in pension until he turned 75 if he had received a 100 percent withdrawal rate from the start. The summary is made by an AI service from OpenAI. The content is quality assured by news’s journalists before publication. – You get angry and sad. When we discovered that dad has lived on a 50 per cent pension payment for eight years, from the time he was 67 until he was 75, we thought that something in the system was amiss. Eivind Westhagen (40) sits in the living room at home in Lysaker in Oslo. On the living room table are papers and documentation from Nav. They belong to his father Arild Westhagen (79), who died last autumn in Drammen. – It hurts to think how he really felt. He hid how bad things were and probably didn’t want to bother the children. It’s a big stigma to be poor, says Eivind Westhagen thoughtfully. Eivind Westhagen found out that his father lived on less than NOK 8,500 a month. Photo: Henning Rønhovde / news After the family cleaned out the estate and started looking at papers, they suspected that “something was seriously wrong”. – My investigations only revealed more and more – and confirmed the suspicion, says the son. Far below the poverty line When Arild, aged 67, became the recipient of an old-age pension in 2011, he went from being 50% unemployed and 50% on disability benefits partly due to a stroke. He was then paid NOK 8,457 per month (50 per cent withdrawal rate), an amount which is automatically determined by Nav. – Was he aware that he was entitled to more? – Had he been aware of that, he would undoubtedly have adjusted the withdrawal rate up, and had a more dignified old age. He stated that there wasn’t much you got as a minimum pensioner, replies Eivind Westhagen. Arild received approximately NOK 102,000 a year. The poverty line in Norway for a single person is calculated at approximately NOK 275,000 after tax (based on the EU’s indicator) according to Statistics Norway. Nav says you can choose for yourself Pia Høst is director of Nav family and pension benefits: – If you have some degree of disability benefit, you will have that degree of disability automatically calculated for old-age pension. Then you can choose when you want to withdraw: For example, graduated and work on the side, and then save the pension for later – and get more paid out when you get older. Pia Høst is director of Nav family and pension benefits. Photo: Henning Rønhovde / news – Why not just a 100 percent withdrawal rate right away? – That is because it is up to you to choose when you want to withdraw. After all, many people want to stay longer in working life. The tendency is that we see more people wanting to work a little on the side. You may also have other pension schemes or other income which means that you do not want to draw a full pension straight away, Høst answers. Nav says they have “great understanding that this must have been a difficult situation” – and that they cannot go into more detail about exactly what has happened in this case, “since he cannot consent to us making a statement”. Read the full answer from Pia further down in the case. – His full and complete duty Throughout his retirement, Arild is increasingly struggling with his health, both physically and mentally. He does not own his own home, has to move, the housing situation worsens and he isolates himself more and more. In 2017, he is in such bad shape that he asks his daughter Katja for help. Katja applies for him to a private foundation with apartments for the financially disadvantaged in Drammen, where he meets the requirements and is put on a waiting list for the allocation of an apartment. He applies to the Housing Bank for housing benefit, which is granted because his low pension income Arild together with children Eivind and Katja. The picture was taken just before the last boat trip on the Oslofjord, the day after Arild’s 79th birthday, two and a half months before he died. Photo: Private – Nav says they have sent out the information letter, as well as the decision letter and have thus done their full duty. After that, you never hear from them again regarding the withdrawal rate, says Westhagen. – What if that letter never reached Arild’s mailbox? We demanded transparency in all communications. Was initially refused, but eventually sent a printout. The letter from 2011 states that the disability pension will be converted into an old-age pension and that he does not need to submit an application for this. This photo was taken in 2017, just days before he told his family how bad things were financially and psychologically, says Eivind. Photo: Privat – The system is like that, simply Nav answers Pia Høst says that when you turn 75, Nav has calculated that it is no longer worthwhile for you to have a degree. Then everyone should withdraw 100 per cent to get what you are entitled to in the total pension. – But why shouldn’t the partially disabled get 100 per cent? – They can do it. But it’s up to you. It is a right you have. – Why should an aging person with poor health wait to collect their full pension? – If you are 50 percent disabled, you are 50 percent able to work. You may want to continue with it after you are 67. If you are not in good health, you can apply for a 100 per cent old-age pension. Høst says that this is how the Folketrygdloven is set up, and that it is your right to choose. – Then we provide information about this before you turn 67, and in the decision when you transfer to the old-age pension. We say: Get in touch and apply. If you do not understand the information, it is important that you contact us. – But why not the opposite? Why not apply for a degree instead of full? – We don’t know when people want to have a full pension. And now we see that more and more people want to work longer. This is the Norwegian National Insurance Act’s system: You have a right, but you must apply. The system is simply like that. It is determined by law, because you and I should be able to choose for ourselves what we think is best for us, health-wise and financially. – Do you think this information is clear enough? – We work all the time to provide good information. It is very sad to hear that someone has not understood it. If you don’t understand, don’t hesitate to get in touch. Nav refers to this page: When is it worth taking out a retirement pension? “Nav has followed the rules” Eivind believes that Nav can improve the information with simple steps: By using better language and by ensuring that each monthly payment should be followed by a “payslip” with information on the withdrawal rate you have and that this can be adjusted upwards. – The annual statement is also so misleading that it makes you think you are receiving a full pension. – When you realize why dad was the way he was during these years, a lot can probably be attributed to not being able to afford it. It hurts to think about, says the son as he fights back tears. – You get an aversion to the system and the politicians who have decided that “that’s the way it should be”. I think it is a government saving measure, which was the pension reform from 2011, and where dad was part of the first generation, he continues. Eivind Westhagen asks: – Why should an aging, poor man with failing health want to wait to collect his full pension? Photo: Anders Haualand / news Westhagen says that “this affects everyone who, for various reasons, may not be able to find out their rights themselves. A group with a lower average life expectancy and where the injustice may not be so easily detected”. Arild in Tingelstad church, summer 2018. Photo: Privat – You must therefore be able to familiarize yourself well with the system, in order to get what you are entitled to. – What do you think Nav has done wrong? – The funny thing is that Nav has not done anything wrong. Nav has followed the rules, the system is completely backwards, but Nav must quality-assure that the information reaches them. “Delay – and get a higher old-age pension” Ellen Bakken (Ap) is state secretary in the Ministry of Labor and Inclusion. Photo: Simen Gald / Ministry of Employment and Inclusion Ellen Bakken is state secretary in the Ministry of Employment and Inclusion. She says the following: – Everyone must be confident that they will receive the pension they are entitled to, and Nav must provide good information to the individual. Read the full answer below: Answer from the Ministry of Employment and Inclusion – Those who work, fully or partially, choose for themselves when to draw a pension and with what proportion. This also applies to those who are classified as disabled. They are usually in work, and can choose to stay in work longer, postpone the withdrawal of parts of the pension and thus receive a higher annual old-age pension. – Why is the system such that the retirement pension automatically matches the degree of disability? – Disability benefit from the national insurance is granted until the age of 67. For those who are 100 per cent disabled, it has been chosen that the old-age pension starts at the same age, unless you ask for it to be paid out later. Those who are disabled, but have a degree of disability lower than 100 per cent, are usually partially employed and must choose for themselves when to stop working and when to draw an old-age pension. If you are 50 per cent disabled, you automatically receive a 50 per cent old-age pension from the age of 67 when the disability benefit ends. You can choose to withdraw up to 50 per cent of your retirement pension from the age of 62, wait until the age of 67 or until the age of 75. The overall amount you get in retirement pension is higher the later you take it out, answers Ellen Bakken (Ap), State Secretary in AID. I think it could hit a couple of thousand a year. The survivors say that the purpose of telling their father’s story is to reach out with knowledge to others in the same situation and a hope of changing the system. – The legislation must be changed to the opposite practice: The starting point must be automatically awarded 100% old-age pension. Someone should take responsibility and admit that the system is completely wrong. Figures from Nav show that approximately 2,300 people go from graded disability benefits to old-age pensions annually, and that in the autumn of 2023 there were almost 3,000 people aged 67 to 74 who received graded old-age pensions. Westhagen believes the same thing that happened to his father could affect a couple of thousand a year. – With such a striking similarity in numbers: If these 3,000 people were asked if they were aware of their level of withdrawal, how many would keep their graded old-age pension, wonders Eivind Westhagen and adds: – Dad’s case cannot possibly be the only one in this country. The Pensioners’ Association urges Nav to investigate Chief Economist at the Pensioners’ Association, Sindre Farstad, says this is a problem they have not encountered before. Sindre Farstad is chief economist at Pensjonistforbundet. Photo: Johan B. Sættem / news – But there may still be a number of people who are affected, he says and points out that as of March 2024 there were 18,627 people with graduated withdrawals in the country. – Is this something you would like to investigate? – The Pensioners’ Association will urge Nav to investigate whether there are people over the age of 67 who are not in work and who receive a partial old-age pension. These should receive information from Nav that they can increase the withdrawal rate to 100% if they wish. Eivind finds it painful to think that Arild could have had a better old age, but takes solace in the fact that his father had a much better quality of life after the age of 75 when the finances/pension got back on track. Photo: Henning Rønhovde / news Got better in recent years The survivors have calculated that the father would have received approximately NOK 816,000 more in pension up to the age of 75 – if he had received a 100 percent withdrawal rate from the start. These are calculations made from the annual statements from Nav. When Arild turned 75, Nav automatically increased his pension to 100 per cent, from NOK 9,900 to NOK 29,000 per annum. md. – But before that it ensured eight unnecessarily tight years in poverty, concludes Westhagen. Arild got better towards the end. Here from a restaurant visit with daughter Katja in March 2023. Photo: Private Published 05/09/2024, at 13.13 Updated 05.09.2024, at 13.51

ttn-69

Arild received NOK 100,000 less a year than what he was entitled to from Nav – news Buskerud – Local news, TV and radio