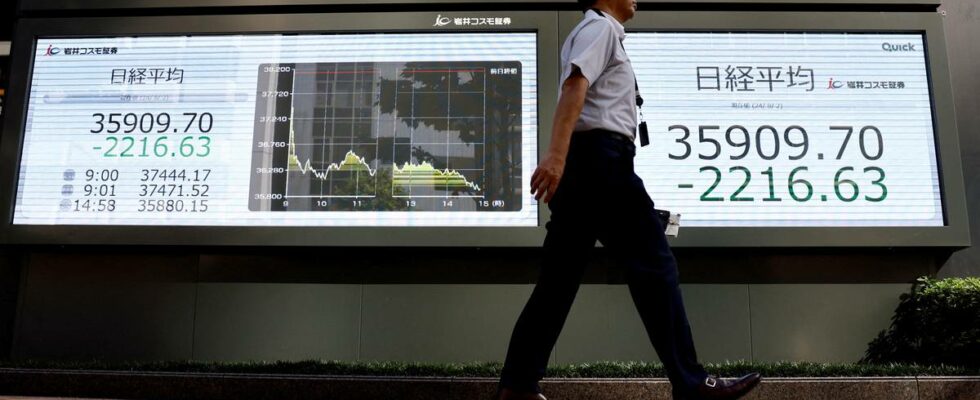

Trading opened first in Asia, where the Japanese Nikkei index stood out with a historic stock market fall. The index plunged 12.4 percent. At 09.00, the Main Index opened on Oslo Børs with a sharp decline of 4 per cent. There are also extreme effects in the financial markets elsewhere: The stock market fall in Asia: The steepest fall came in Japan. The Hong Kong stock exchange Hangseng fell by 2 percent, while the South Korean Kospi index fell by more than 8 percent. The Chinese Shanghai index fell by just over 1 percent. The currency market: The Norwegian krone is weakening sharply against the major trading currencies. The euro has strengthened by 0.85 per cent and costs over NOK 12, while the dollar has strengthened by 0.91 per cent and costs over NOK 11. The price of oil: The price of North Sea oil has fallen to 76 dollars a barrel, after a drop of 1.65 percent today. The main index on Oslo Børs fell four percent when it opened on Monday. Photo: NTB Fear of an economic downturn in the USA Several analysis circles believe that investors are less willing to take risks to make money now, according to several international media such as Reuters. The question is whether the economy in the United States is as strong as most have thought. Until recently, most people believed that the US economy had coped well with a sharp rise in interest rates in recent years. But on Friday, figures showed that unemployment is rising in the United States to 4.1 percent. – That unemployment increases too quickly is often a sign of bad times, and then companies will make less money, says chief analyst Erik Bruce at Nordea Markets. He points out that the Japanese stock market in particular went on a rampage, because it has risen a lot in recent years because the currency has become weaker. – The export companies make good money, but now things are changing a bit because what is happening in the USA. So Japan knows a lot about it, the rest of the global market will too, but not to the same extent as in Japan, he says. Believes in faster interest rate cuts Bruce indicates that the market now believes that the US central bank will lower interest rates more quickly to counter the unrest. – The market is driven by fear, so unemployment gave rise to fears of a recession. What people now think is that the American central bank, which has said that they will cut interest rates, is in arrears and is moving far too late. Now the market believes that one should not just cut by a quarter of a percent, which is usual, but by half a percentage point at the next meeting. Published 05/08/2024, at 08.55 Updated 05.08.2024, at 09.19

ttn-69

Violent global market turmoil – now Oslo Børs is also raging – news Norway – Overview of news from different parts of the country