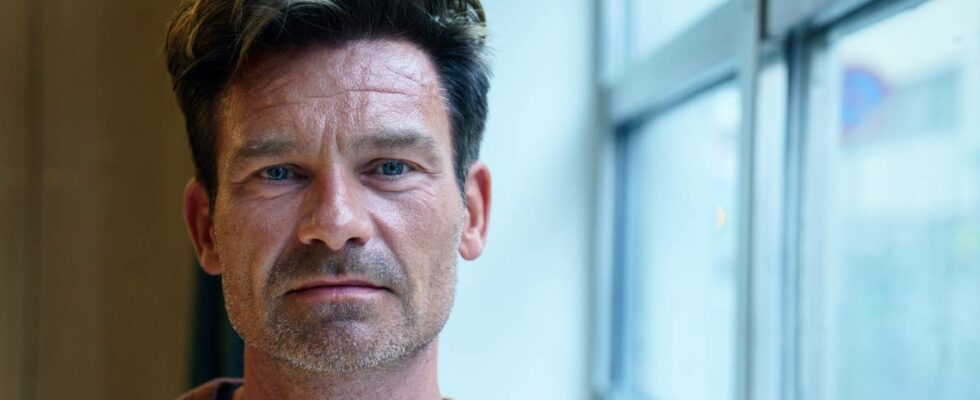

On Thursday, the Norwegian krone reached levels we have not seen since the start of the corona pandemic. Many thought the interest rate peak had been reached. But maybe not? Now there are several economists who wonder whether we will see an interest rate rise in the autumn – precisely to strengthen the krone. The chief economist at LO, Roger Bjørnstad, is a strong opponent of this. He refers to the high debt of Norwegians, which means that an even higher interest rate will sting. – Are we supposed to switch to a kind of exchange rate management with interest rates? It will be very harmful for the Norwegian economy, Norwegian companies and Norwegian households, he says to news. Bjørnstad claims that the weak krone exchange rate is due to international conditions on which the Norwegian interest rate setting does not have much of an impact. He substantiates the claim by pointing to Sweden, where just before the summer they lowered interest rates, and at the time of writing has a slightly stronger krone exchange rate than in Norway. Therefore, he rather advocates that Norges Bank should be able to use more other tools than just the interest rate in its monetary policy. – Defending the krone exchange rate without using other instruments seems very strange to me, says Bjørnstad. He believes we should consider using the Oil Fund’s money to buy Norwegian kroner, thereby strengthening the krone exchange rate. Currency trader Tor Vollaløkken also thinks it could be an idea, writes Dagens Næringsliv. The proposal causes chief economist at DNB Markets, Kjersti Haugland, to stiffen. She makes a call about Norges Bank’s mandate and task, and is clear that it should be fixed. She is supported by Nordea’s currency strategist Ole Håkon Eek-Nielsen. Contrary to long tradition, Bjørnstad, for his part, comes with a clear call to Støre and co.: – I would like to ask the government to initiate work to investigate what the monetary policy regulations should look like, what should be the emphasis for Norges Bank in a completely different time than when the inflation target was drawn up. WEAPONS: The interest rate weapon cannot be used against a weak krone exchange rate, says LO economist Roger Bjørnstad, who believes that other weapons must be drawn from Norges Bank’s economic sheath. Photo: Jonas Been Henriksen / Jonas Been Henriksen Since 2001, Norges Bank’s mandate has been fixed. Norges Bank’s task is not to set the interest rate to achieve a certain krone exchange rate, but to keep price growth at around 2 per cent a year. But a weak krone makes it difficult, because foreign goods become more expensive – and with that contributes to pushing up prices in Norway. Therefore, the krone disorder opens up a debate about the mandate and the monetary policy regime. It is the Storting that decides the mandate of Norges Bank, which today primarily has one instrument that can influence the krone exchange rate: interest rates. Chief economist: No! Kjersti Haugland is chief economist at DNB Markets. She flatly rejects that the politicians will now tamper with Norges Bank’s mandate and instruments. – Is the time ripe to change the monetary policy regime now? – No, I don’t think so. We have no better alternative, replies Haugland. BLANK REJECTION: Norges Bank has what they need, says Kjersti Haugland of DNB Markets about LO’s call for debate. Photo: Tom Balgaard/news She has no faith in using the Oil Fund to buy up Norwegian kroner to strengthen the exchange rate. According to her, this has been tried without success in other countries. – I think that is a particularly bad idea. However, she believes that the bank can today intervene in the foreign exchange market if necessary. – In the winter of 2020, Norges Bank stepped in and bought support for Norwegian kroner to stabilize the exchange rate, which was then affected by a negative spiral. She is not as worried as Bjørnstad when it comes to using the interest rate weapon against a population with a lot of debt. On the contrary, she believes the Norwegian economy is doing surprisingly well with today’s interest rate level. – So there is actually no particular sign that the economy is suffering greatly from the level of interest we have. – Should there be any limit to how weak the Norwegian krone can become? – I think this is the level we have to count on going forward. We have to get used to paying twelve kroner for one euro, because the Norwegian economy is not what it was ten or twelve years ago. Published 26/07/2024, at 19.21

ttn-69

LO believes Norges Bank needs more instruments – news Norge – Overview of news from various parts of the country